An annual administration Fee ("Administration Fee") of 20 (twenty) basis points will be charged in respect of each and every trading account held with The Standard Bank of South Africa Limited under the Terms of Business ("Terms"). The administration Fee is calculated as follows:

Advisory services are provided to clients through SBG Securities (Pty) Ltd (acting through its Stockbroking Division). Advisory fees may be charged and such fees will be deducted off your trading account held with the Standard Bank of South Africa Limited under the Terms. Please contact your equity advisor for further details in this regard.

Net Free Equity is defined as:

Account Value is defined as:

The following interest rates apply to funds deposited with Standard Bank:

There are annual IRS reporting obligations for each income stream earned on US Exchanges.

Read here for more info

For all margin products you finance the traded value through an overnight credit/debit charge. If you open and close a margin position within the same trading day, you are not subject to overnight financing.

If the financing credit is negative it will be debited from your Webtrader account.

Overnight Financing on CFDs

When you hold a Single Stock CFD position (or an ETF/ETC CFD position) overnight i.e. have an open CFD position at close of market on the Stock Exchange, your CFD position will consequently be subject to the following credit or debit:

When you hold a long CFD position, you are subject to a debit calculated on the basis of the relevant Inter-Bank Offer Rate for the currency in which the underlying share is traded (e.g. LIBOR) plus a mark-up (times Actual Days/360 or Actual Days/365).

When you hold a short CFD position, you receive a credit* calculated on the basis of the relevant Inter-Bank Bid Rate for the currency in which the underlying share is traded (e.g. LIBID) minus a mark-down (times Actual Days/360 or Actual Days/365).

The credit/debit is calculated on the total nominal value of the underlying Stock(s) at the time the CFD contract is established (whether long or short).

Should the relevant Inter-Bank Bid Rate minus the mark-down result in a debit as opposed to a credit, then you will pay the finance charge.

No Overnight Financing on US2000 Index Tracker

As the price of the US2000 Index-Tracking CFD tracks the price of the underlying Futures Contract no overnight financing shall apply.

Tom/Next Rollover on FX Spot

All open FX positions held overnight are subject to a debit or credit interest rate revaluation to reflect the position being rolled over to a new Value Date. The operation known as the Tom/Next Rollover is applied to spot positions held at 17:00 Eastern Standard Time (New York time) on any given trading day.

The 'rollover' is made up of two components, namely the tom/next swap points and financing of unrealised profits or losses. The accumulated combined rollover credit or debit is added/deducted from the previous opening price of the position.

A borrowing cost may be applied to short CFD positions held overnight. This borrowing cost is dependent on the liquidity of the underlying Stocks and may be zero (0) for high liquidity Stocks.

The specific borrowing rate for a Single Stock CFD can be seen as the 'Borrowing Rate' under 'Account' > 'Trading Conditions' > 'CFD Stock/Index Instrument List' in the trading platforms.

When selling a Single Stock CFD, the borrowing cost for holding the position overnight is shown in the CFD Trade module in the 'Estimated borrowing cost per day' field.

The borrowing rate will be fixed when the position is opened and will be charged on a monthly basis. Please be aware, that for certain corporate action events, the borrowing rate on the short position may be reset to the current rate in the market, upon the execution of the corporate action.

Data subscriptions for real-time prices

At Standard Bank all equities trade on actual market data from the stock exchanges.

To receive and trade on real-time market data, you will have to subscribe independently

to the individual exchange via third party providers.

A subscription to live price data from an exchange gives you access to live prices

on Shares and ETFs/ETCs from the particular exchange.

An Online Subscription Tool is available in the Trading Platform. In the tool, you

will find a list of available exchanges and news services alongside the applicable

monthly fees. You will be able to subscribe and unsubscribe to services of your

choice. Further information can be found in the Subscription Tool guide, which is

also available on the Trading Platform.

Level 1 or Level 2 data

Level 1 price data refers to the first level of the order book on the exchange.

With a Level 1 subscription you can see live, streaming, bid and offer prices.

With a Level 2 price data subscription you can see live, streaming prices as with

Level 1 but on top of this you can see the market depth of bid/offer prices and

the amounts available at each price point.

Level 1 and Level 2 Exchange Data Fees

| Exchange | Level 1 | Level 2 | ||

|---|---|---|---|---|

| Private | Professional | Private | Professional | |

| NYSE MKT (AMEX – American Stock Exchange) | 1.00 USD | 30.20 USD | Only Level 1 | |

| Athens Exchange (AT) | 1.00 EUR | 7.00 EUR | 10.50 EUR | 10.50 EUR |

| Australian Securities Exchange (ASX) | Only Level 2 | 37.50 AUD | 45.00 AUD | |

| BME Spanish Exchanges (SIBE) | 4.25 EUR | 16.00 EUR | 12.50 EUR | 39.50 EUR |

| Budapest Stock Exchange (BUX) | 1.00 EUR | 12.00 EUR | 2.00 EUR | 22.00 EUR |

| NYSE Euronext (PAR, BRU, LISB and AMS)* | 1.00 EUR | 59.00 EUR | 1.00 EUR | 84.00 EUR |

| Deutsche Börse (XETRA) | 15.00 EUR | 56.00 EUR | 20.00 EUR | 68.00 EUR |

| Hong Kong Exchanges (HKEx) | 120.00 HKD | 120.00 HKD | 200.00 HKD | 200.00 HKD |

| Istanbul Stock Exchange (ISE) | 15.34 TRY | 15.34 TRY | Only level 1 | |

| London Stock Exchange (LSE_SETS) | 4.00 GBP | 37.00 GBP | 6.00 GBP | 157.50 GBP |

| London Stock Exchange (LSE_INTL – IOB) | 2.00 GBP | 20.00 GBP | Only level 1 | |

| Borsa Italiana/Milan Stock Exchange (MIL - Equities and Futures) | 0.50 EUR | 12.00 EUR | 1.20 EUR | 40.00 EUR |

| NASDAQ* | 1,00 USD | 20,00 USD | Only level 1 | |

| New York Stock Exchange (NYSE) | 1.00 USD | 127.25 USD** | Only level 1 | |

| New York Stock Exchange (ARCA) | 6.00 USD | 26.00 USD | Only level 1 | |

| NASDAQ OMX Exchanges (CSE, SSE and HSE)* | 1.00 EUR | 29.00 EUR | 5.00 EUR | 56.00 EUR |

| Oslo Børs/Oslo Stock Exchange (OSE) | 10.00 NOK | 280.00 NOK | 100.00 NOK | 280.00 NOK |

| Prague Stock Exchange (PRA) | 2.50 EUR | 10.00 EUR | 5.00 EUR | 20.00 EUR |

| Singapore Exchange (SGX-ST) | 8.00 SGD | 8.00 SGD | 30.00 SGD | 30.00 SGD |

| SIX Swiss Exchange (SWX + VX) | 6.00 CHF | 15.00 CHF | 50.00 CHF | 50.00 CHF |

| Tokyo Stock Exchange (TYO – Equities and Futures) | 120.00 JPY | 2200.00 JPY | Only level 1 | |

| Toronto Stock Exchange (TSE and TSX)* | 9.50 USD | 58.00 USD | Only level 1 | |

| Toronto Stock Exchange (TSE) | Only Level 2 | 9.00 USD | 30.00 USD | |

| Wiener Börse/Vienna Stock Exchange (VIE) | 2.00 EUR | 33.00 EUR | 3.00 EUR | 43.00 EUR |

| Warsaw Stock Exchange (WSE) | 12.40 PLN | 136.75 PLN | 80.10 PLN | 136.75 PLN |

* Denotes multiple exchanges covered by a single agreement.

** The Price for New York Stock Exchange (NYSE) varies with the number of devices/users a client subscribes to. Example: one client considered to be a professional must pay USD 127,25. Two users marked as 1 professional client must pay 2 X USD 79,50/month:

| Devices / users on NYSE | Professional |

|---|---|

| 1 Device | USD 127.25 |

| 2 Devices | USD 79.50 |

| 3 Devices | USD 58.25 |

| 4 Devices | USD 53.00 |

| 5 Devices | USD 47.75 |

| 6-9 Devices | USD 39.75 |

| 10-19 Devices | USD 31.75 |

| 20-29 Devices | USD 30.25 |

|

|

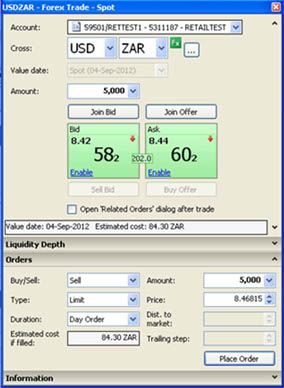

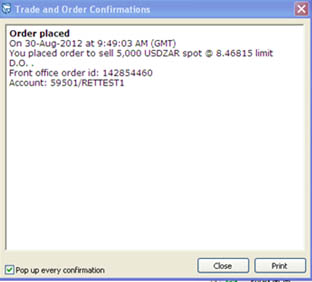

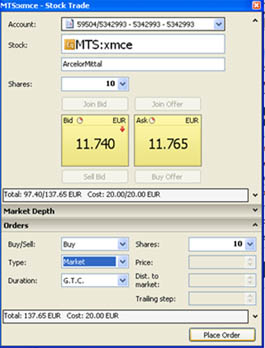

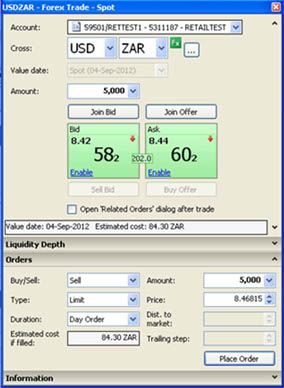

A Practical Example

You place an order for 10 Arcelor Mital shares at the delayed asking price

of €11,765 per share. Due to your trade size, the minimum commission of €20 is levied,

thus bringing the total of your trade to €137,65 (being 10 shares at 11,765 each

plus €20,00 commission).

|

|

|

|

Support offered in English only |

|

|

|

South Africa: 0860 121 555 |

|

|

International: +27 11 415 6555 |

|

|

Send a general query |

|

|

Call centre hours (SA)

Monday to Friday 8:30am GMT+2 until New York Market Close Excluding Internationally recognised Holidays |

|

|

|

© 2012 Standard Bank is a licensed financial services provider in terms of the Financial Advisory and Intermediary Services Act